THAILAND

Every door opens more

Airbnb’s contribution to Thailand’s people, places and prosperity

Airbnb’s contribution to Thailand’s people, places and prosperity

Every Airbnb door opens more. A place to stay becomes a place to spend. A host becomes an employer and a guest becomes a contributor. These may be small, individual choices but together, they add up to something bigger: a platform that drives real economic growth.

From heritage homes in Chiang Mai to seafood barbecues in Phuket, each Airbnb stay adds strength to the Thai economy. They generate jobs, channel spending into communities and connect travellers with destinations that might otherwise remain unseen.

Short stays: big impact

In 2024, Airbnb activity contributed THB 72 billion to Thailand’s GDP: THB 30 billion from direct impact and a further THB 42 billion through the ripple effects of guest and host activity. Nearly 110,000 jobs were supported by the economic activity Airbnb generated along the way.

Supporting local communities beyond hosts

Supporting local communities beyond hosts

The economic value generated by Airbnb extends beyond just what hosts earn. It also supports broader livelihoods, contributing THB 15.8 billion in wages for everyday Thais.

Top sectors by GDP contribution

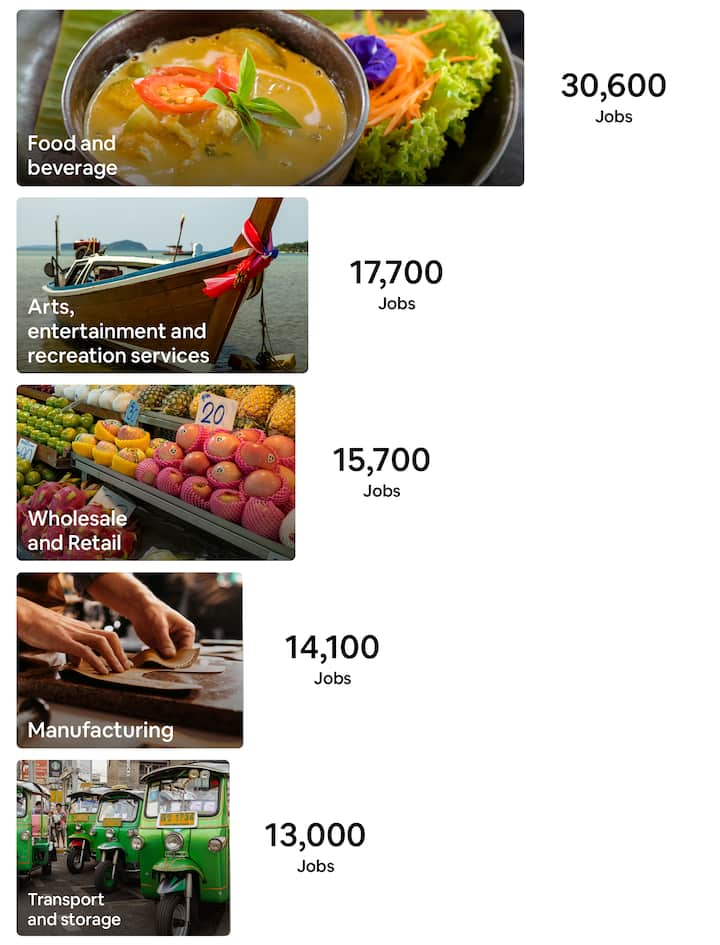

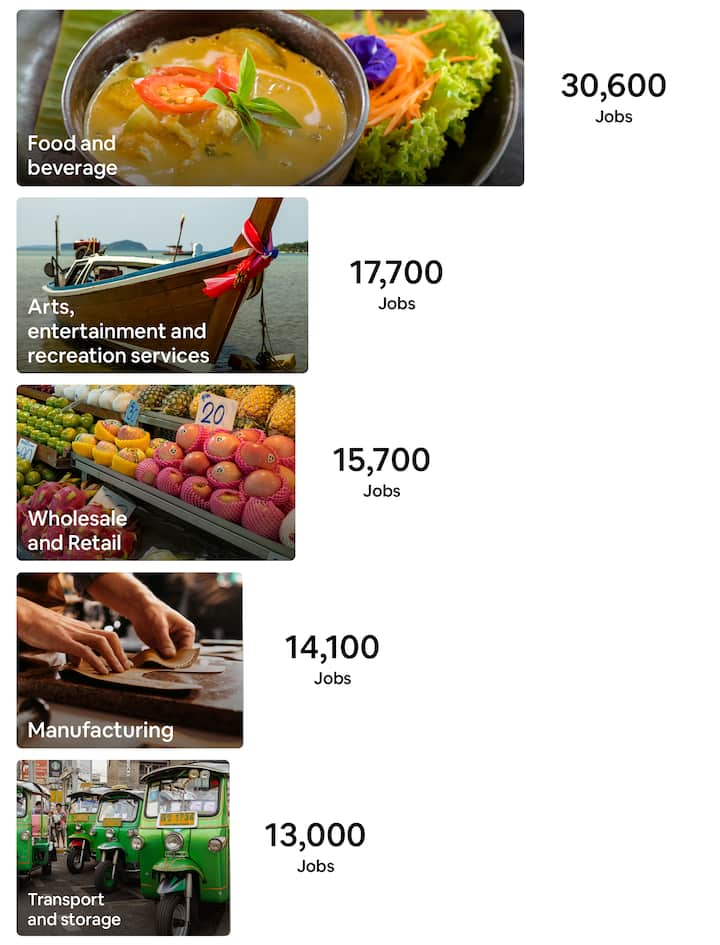

Top sectors by jobs supported

Spending by guests typically includes transport, dining, entertainment and local services. Guests spend on transport, food, services and entertainment and hosts rely on contractors, tradespeople and cleaners. These ripple effects help bring tourism benefits directly into local communities.

The guests behind the spend

In 2024, international travellers made up 91 percent of Airbnb guests in Thailand drawn from Asia Pacific, Europe and North America. Across all guests the average spend was THB 4,400 per guest per day in non-accommodation spending, fueling local economies and small businesses across the country. This highlights Airbnb’s role in supporting international travel into Thailand and helping spread tourism benefits more evenly across the country.

Where they go

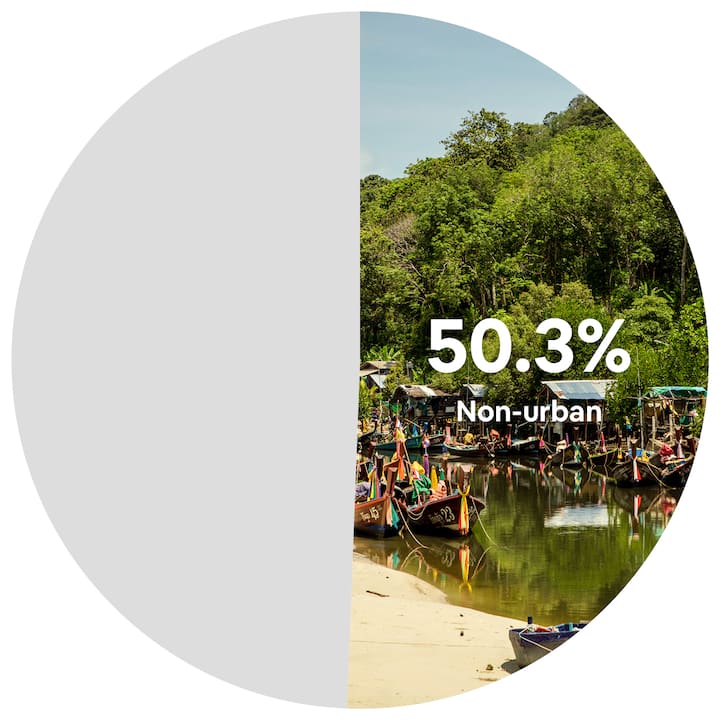

More than half of all Airbnb accommodation spending occurred outside of Thailand’s primary cities, such as Bangkok, Phuket and Chiang Mai. This 50.3 percent share in non-urban regions reflects Airbnb’s strong ties to local communities and its role in promoting more evenly distributed tourism throughout the country.Since 2019, Airbnb spending outside urban centres has increased by four percentage points in real terms. This growth reflects Airbnb’s ability to unlock travel in areas with limited traditional hotel infrastructure, supporting national tourism dispersal strategies such as the loop.

Major destinations

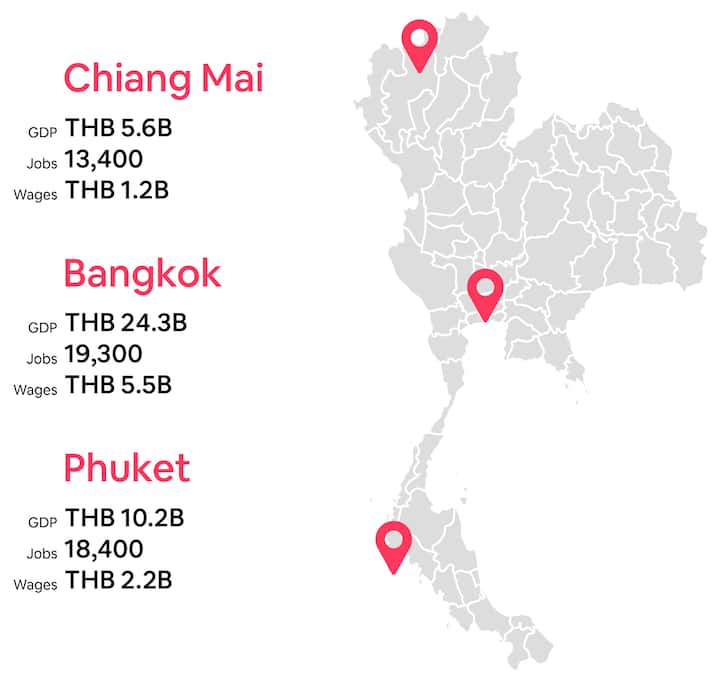

While Airbnb’s economic value is widely dispersed across Thailand, three destinations illustrate the platform’s ability to scale across different tourism geographies.

Host spotlight

Each booking sustains more than just a single host. It creates livelihoods and supports families. Across Thailand, hosts are helping tourism dollars reach local communities by turning homes into engines of economic opportunity . Whether in highland villages or coastal towns, these hosts serve as gateways to their communities, capturing value that might otherwise bypass them.

Ohm

Bangkok, Thailand

"I realised that it’s not that tourists don’t want to come to my neighbourhood, but they just don’t know about it! They love to live among the locals and also to see all the ceremonies and the daily life of the monks, the temple school. We don’t serve breakfast, I give them a coupon so they can get food from local street vendors in the morning. The local people now see hope and it’s more lively because previously only the older generation remained. Now my childhood friends are coming back to the neighbourhood, doing something together, and sticking with their parents."

About the report

Airbnb commissioned Oxford Economics, a world-leading economic analysis and forecasting firm, to assess the impact of Airbnb’s ecosystem on communities throughout Asia Pacific.

Our work in Thailand

Related links

Data source: Airbnb, Oxford Economics. Data based on 12 months from 1 January to 31 December 2024.